July 1, the Arrangement on “the Mutual Recognition of the Enterprise Credit Management System of the Customs of the People’s Republic of China (PRC) and the Secure Exports Scheme of the Customs Service of New Zealand” was implemented by the General Administration of Customs of the PRC and the Customs service of New Zealand.

According to such arrangement, an “Authorized Economic Operator” (AEO) recognized by one of both Customs will be mutually recognized by the other one.

What is an AEO?

The World Customs Organization (WCO) introduced the AEO Program to both Customs members with the aim of establishing standards that provide supply chain security and facilitation at a global level to promote certainty and predictability.

In this respect, the “Framework of Standards to Secure and Facilitate Global Trade” was published by the WCO.

Under this program, an AEO is a party involved in the international movement of goods in whatever function that has been approved by, or on behalf of, a national Customs administration as complying with the WCO or an equivalent supply chain security standard. An AEO includes inter alia manufacturers, importers, exporters, brokers, carriers, warehouse, and distributors.

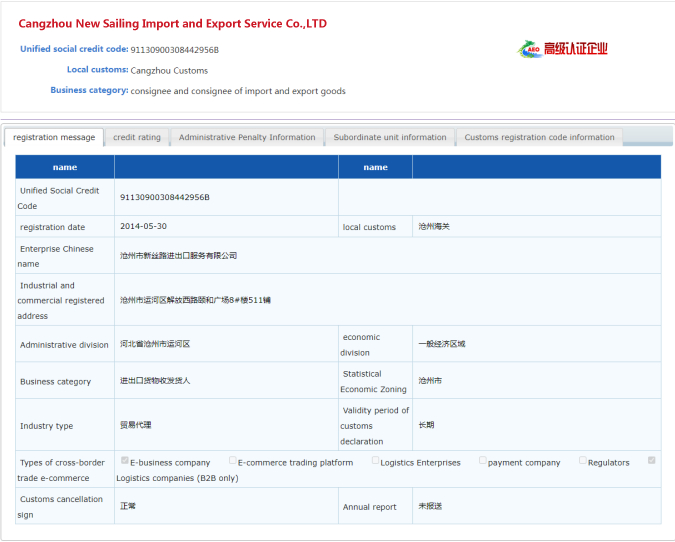

Customs of the PRC have since 2008 incorporated such programs into China. On October 8, 2014, Customs published the “Interim Measures of the Customs of the People’s Republic of China for the Administration of Enterprise Credit” (“AEO Measures”). For the first time, AEO was specified in Chinese domestic regulation. The AEO Measures became effective on December 1, 2014.

Which benefits could be obtained from an AEO Program?

According to the relevant provisions of the AEO Measures, the AEOs are divided into two categories: the general and the advanced. The following concerns the benefits of each.

The general AEOs will enjoy the following facilitation of the customs clearance for imported and exported goods:

1.A lower inspection rate;

2.Simplified examination procedures for documents;

3.Priority in handling customs clearance formalities.

The advanced AEOs will enjoy benefits as follows:

1.Verification and release formalities are handled before the confirmation of the categories, such as Customs valuation, places of origin of the imported and exported goods, and completion of other formalities;

2.Customs designates coordinators for the enterprises;

3.Enterprises trading are not subject to the bank deposit account system (Remark: the bank deposit account system has been abolished by Customs as of Aug 1, 2017);

4.Measures for clearance facilitation provided by Customs in the countries or regions under mutual recognition of the AEO.

With whom has China reached mutual recognition arrangements?

Now, the Customs of the PRC has reached a series of mutual recognition arrangements with other WCO member’s Customs departments, which includes: Singapore, South Korea, Hong Kong, Macao, Taiwan, the European Union, Switzerland, and New Zealand.

The AEOs recognized by China’s Customs will enjoy facilitations granted under the relevant mutual arrangement, such as a lower inspection rate and priority in handling the customs clearance formalities for imported and exported goods.

As China’s Customs concludes more mutual arrangements with other member’s Customs of the WCO, the AEOs recognized will clearly facilitate Customs clearance in more countries.

Post time: Aug-15-2022